Flavours of FIRE (Part 3)

In Part 3 of this FIRE series we discuss the flavours of FIRE.

FIRE as described in Parts 1 & 2 is the classic FIRE path, accelerating to full financial independence and often retiring fully.

However everybody is at a different age, career stage, and earning situation. Everybody values their present and future time differently.

Other flavours of FIRE prove useful in providing different approaches, and motivational milestones.

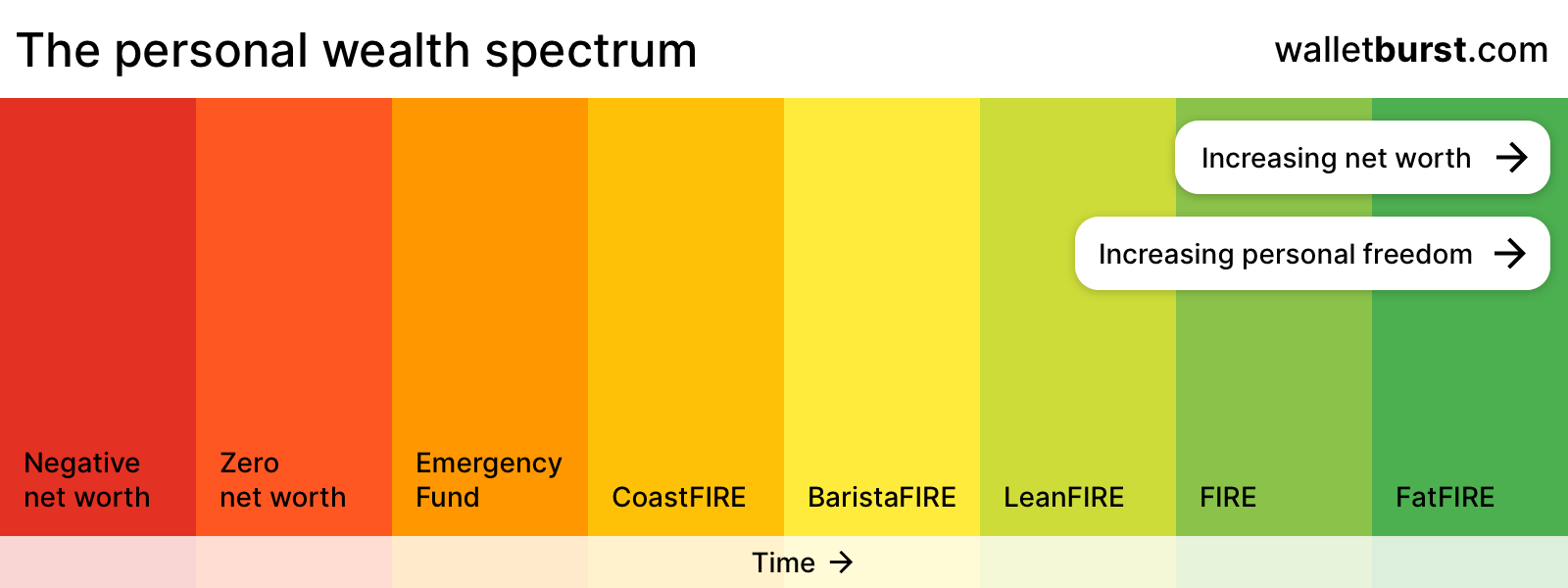

FIRE spectrum

FIRE flavours can be regarded as a journey or spectrum, don’t feel any pressure to reach the end, you may enter and exit at any point!

Source: walletburst

Coast FIRE

Have invested enough that even if you cease contributing now, your pot will naturally grow enough by typical retirement age

Relax a little knowing that your future retirement is secured

You may choose to enjoy more with the money you were investing, alternatively maintain savings rate and target the next flavour!

Best for younger investors with long timelines for powerful compounding, but a motivational milestone for everybody

Barista FIRE

The tastiest of flavours!

Have invested enough that you can draw part of your income, working part-time to make up the rest

Not strictly FIRE, as you do need to work a little, however being able to switch from a higher-stress job and reduce hours brings freedom

Originated in the US where people take a part-time job at Starbucks to get health insurance!

Best for those who want to switch from their current career ASAP and don’t mind supplementing

Lean FIRE

Frugal FIRE

You are ruthless with expenditure, and were probably easily living with a high savings rate and lower spending anyway

Unlike Barista FIRE you are now fully retired with no obligation to work

Though you may also choose to work for a little extra fun money

Best for those who want to fully retire ASAP, and enjoy a simpler lifestyle with lower cost of living area and hobbies

FIRE

Classic FIRE

You are now beyond Coast / Barista / Lean FIRE and reached your full target pot

You can retire fully at a comfortable income level, while perhaps retaining your higher cost of living area and hobbies

Best for those who want full freedom, without being too frugal, and more buffer against unexpected expenses

Fat FIRE

Like FIRE but a fatter retirement!

Spending even in excess of your budget while working

Maximum budget to do whatever you want

Best for those with high incomes, or those willing to have very high savings rate now to live extravagantly when retired

Fancy any FIRE Flavours? Check our Retire Earlier package to measure where you are now, and how to reach one of these milestones